- Forward Guidance

- Posts

- 🫀 Pulse check

🫀 Pulse check

A look at the post-tariff landscape

Welcome back. It’s Thursday, and as our loyal readers know, that means it’s Forward Guidance podcast host Felix Jauvin’s turn to take over the newsletter.

He breaks down the economic reports that dropped today and what it means for trade policy. Here goes:

What’s the data saying?

With a flurry of economic data out today, it’s evident that the US economy is in pretty good shape, churning away despite the ever-unfolding stop-start tariff saga.

Let’s recap the data and what it all tells us.

Retail sales

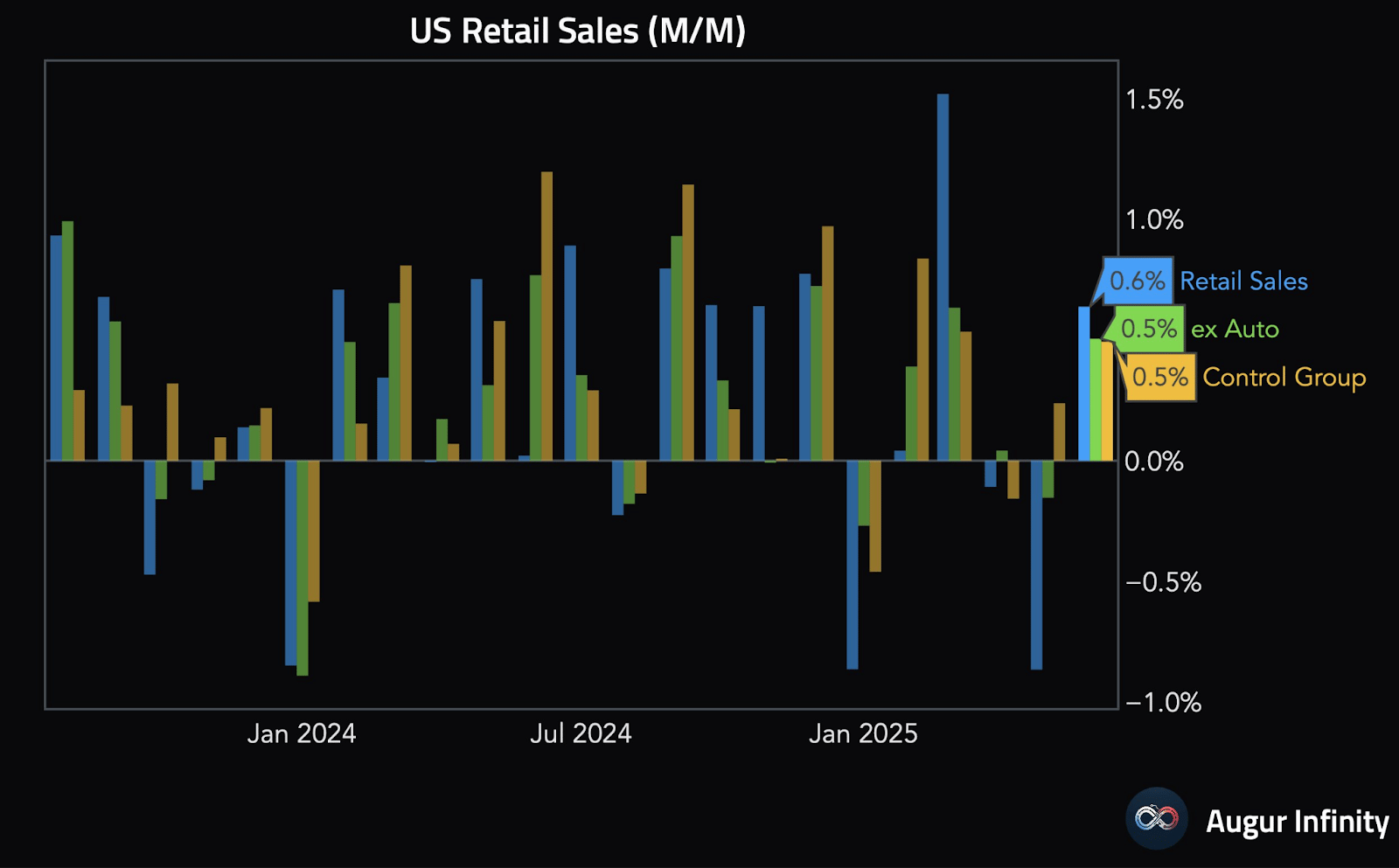

Retail sales came out the gate swinging today, beating most expectations:

Retail sales month over month: Actual: 0.6%; expected: 0.1%

Retail sales control group MoM: Actual: 0.5%, expected: 0.3%

Retail sales (ex autos) MoM: Actual: 0.5%, expected: 0.3%

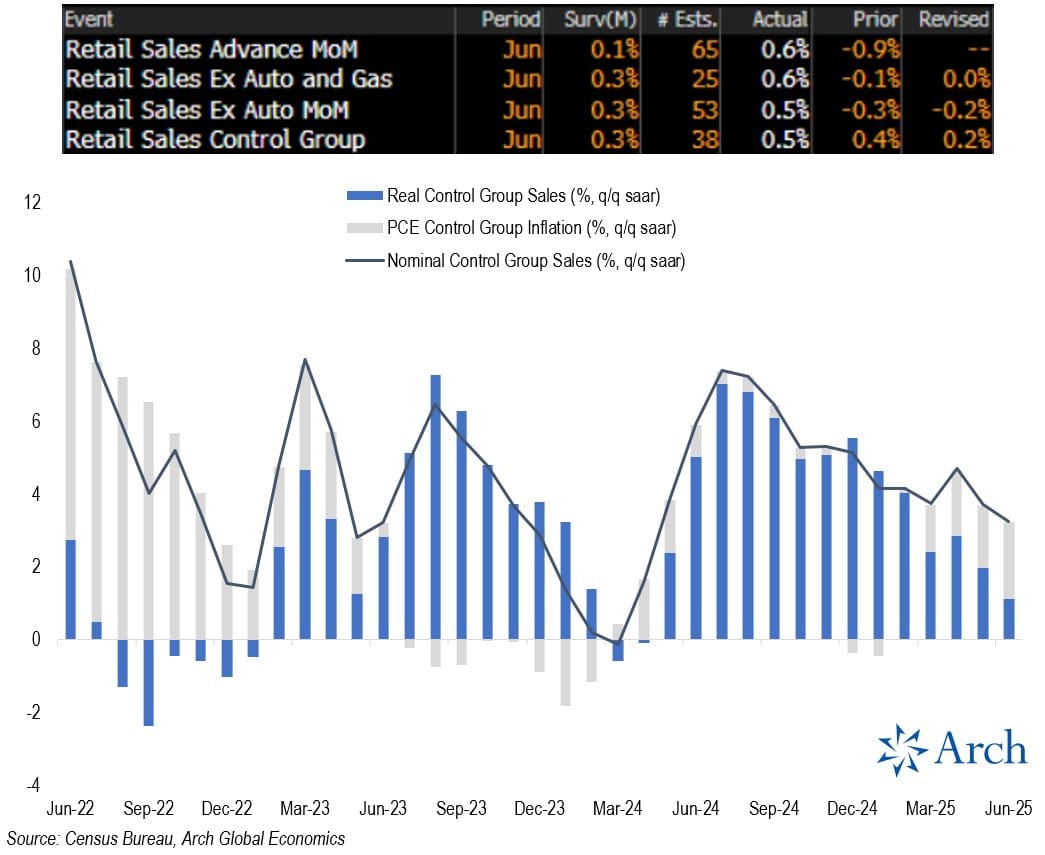

It’s important to remember that retail sales are a nominal metric and therefore include inflation. In an era of persistently above-target inflation, this becomes increasingly pertinent.

Despite the nominal good news, when looking at this chart from economist Parker Ross, you can see how consumers’ purchasing power continues to decline in real terms:

This vignette shows why significant recession is so difficult to trigger in a regime of higher inflation.

A recession could occur on a “real” basis — whilst nominal GDP continues to churn higher — in which the net effect is a decrease in purchasing power, as opposed to a nominal decrease in spending and incomes across the economy.

Philly Fed survey

Setting aside the hard data, we received updates to the Philly Fed survey, which has been exceptionally accurate in recent years.

This soft data shows clear signs of an economy rebounding from Liberation Day uncertainty and adapting to where tariffs stand today.

Across the board, every metric continued higher:

Philly Fed CAPEX index: Actual 17.10, previous: 14.50

Philly Fed employment: Actual: 10.3, previous: -9.8

Philly Fed new orders: Actual: 18.4, previous: 2.3

Philly Fed prices paid: Actual: 58.80, previous: 41.40

Jobless claims

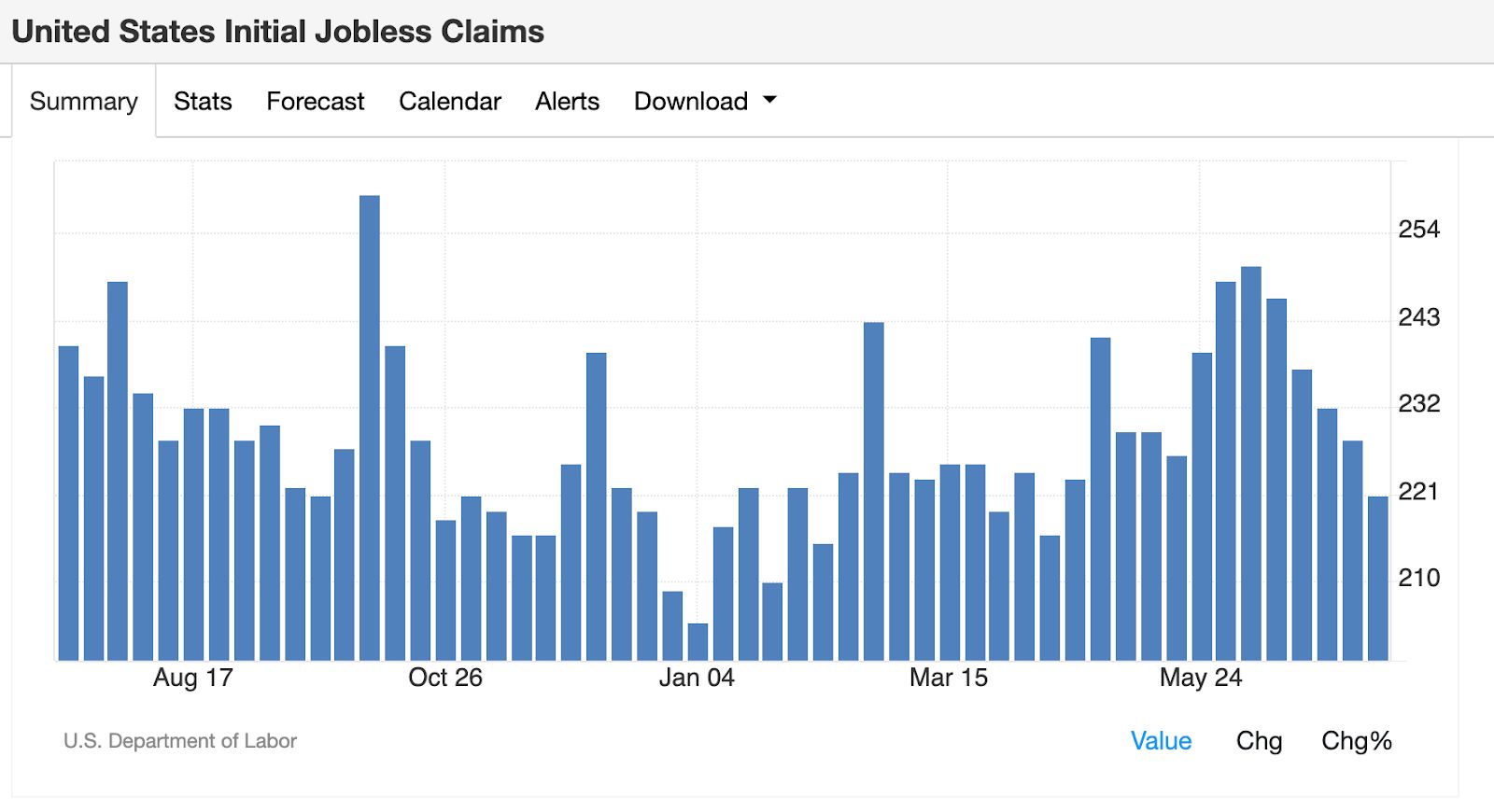

We see further validation of a surprisingly strong economy in the weekly jobless claims data.

Initial claims surprised to the downside and continued their decline:

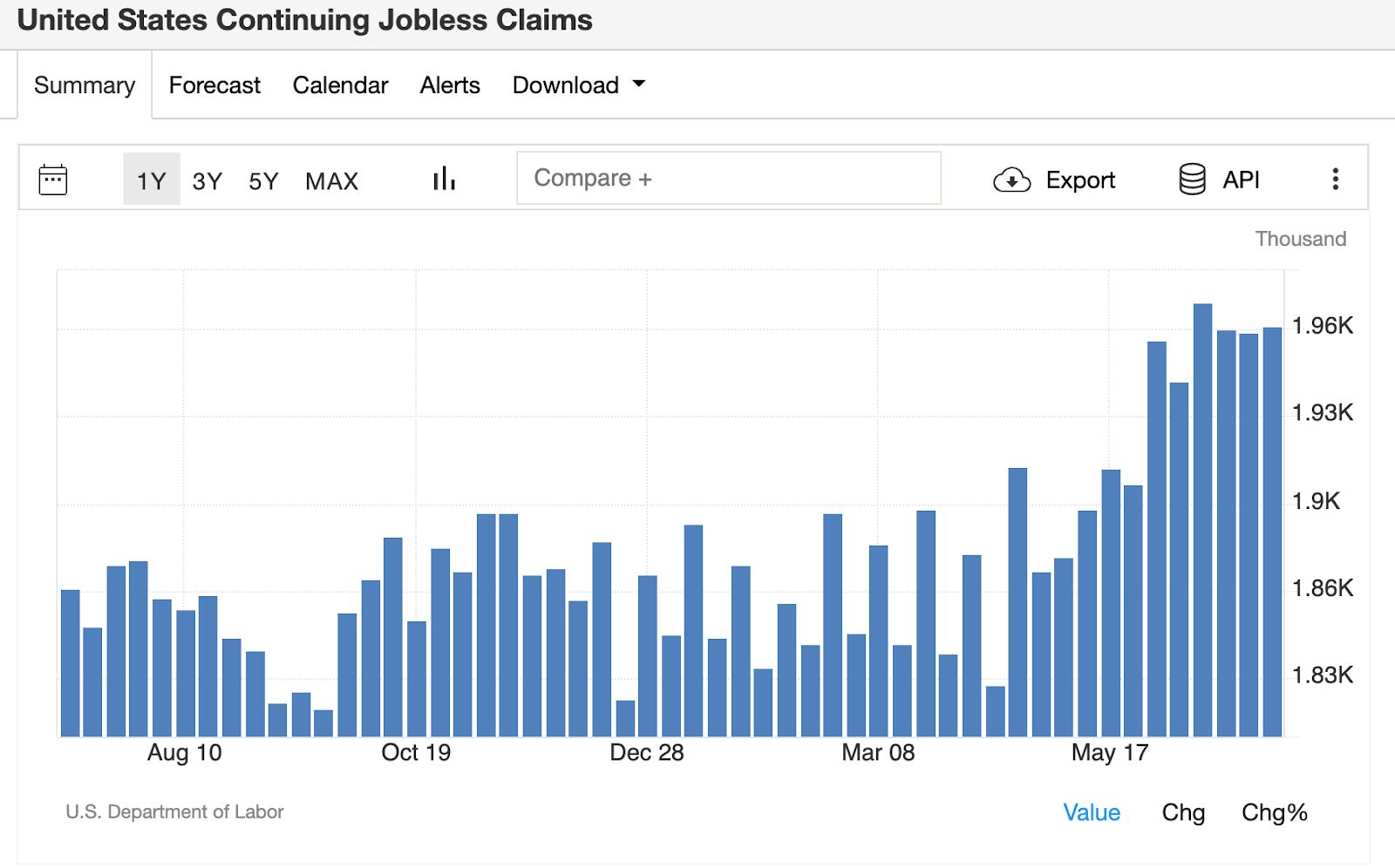

Continuing jobless claims also surprised to the downside, showing signs that the recent surge over the last month has stalled:

This contrast between initial and continuing claims is crucial for understanding the state of the labor market. The economy is solid enough to avoid triggering a meaningful layoff cycle, but weak enough so that those who do become unemployed are having a hard time finding a new job and thus remaining on continuing claims for longer.

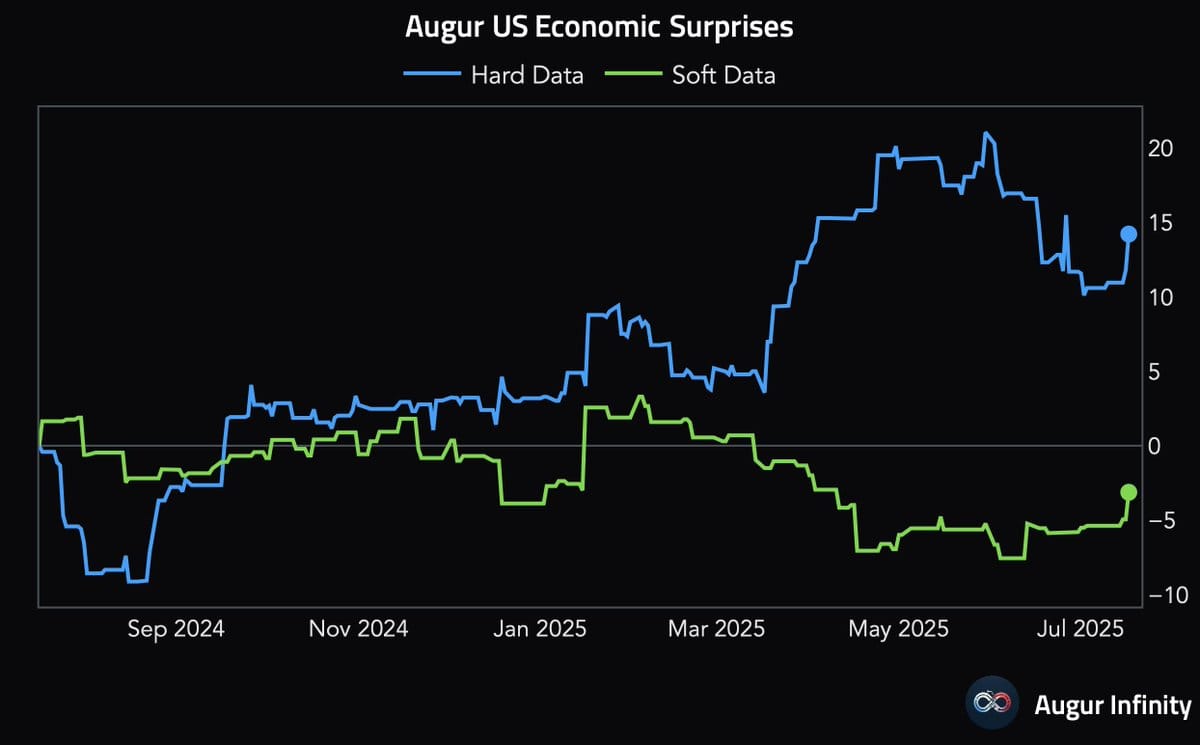

Putting this all together, it’s clear the soft and hard data are beginning to rebound and improve.

— Felix Jauvin

Check out the Digital Asset Summit early speaker lineup. Join attendees from BlackRock, Citi, Credit Suisse, Bank of England, Jane Street and more.

Secure your early bird ticket today with promo code: FGNL

📅 October 13-15 | London

We continue to watch for progress on the crypto bills Congress is mulling. Be sure to check Blockworks.co for updates.

Nasdaq submitted a proposal to add staking to BlackRock’s iShares Ethereum Trust ETF — matching language previously added by other fund issuers. Bloomberg Intelligence analyst James Seyffart noted the SEC’s final deadline to rule on certain other similar proposals comes in October.

Speaking of ETF filings, Canary Capital today filed for a product that would hold INJ — the native token of the Injective blockchain. That fund, if approved, would stake a portion of the INJ (Read Ben’s story here).