- Forward Guidance

- Posts

- 📈 Investor's Digest

📈 Investor's Digest

Inflation, Powell and policy updates

We’re halfway through the week, and Casey has a bevy of market updates as inflation data and crypto bill debate unfolds.

Ben, meanwhile, addresses the latest tokenization-related M&A as companies get set for more regulatory clarity. Let’s go:

What’s moving markets?

US equities were in the red midway through Wednesday’s trading session after inflation data may have started to reflect tariff-related price hikes and President Trump renewed threats to fire Fed Chair Jerome Powell.

Meanwhile, cryptocurrencies were mostly flat as the industry continues to monitor the status of three bills in the House.

There’s a lot to unpack, so let’s get started.

First up: inflation and tariffs. June’s CPI report showed the headline figure increased 0.3% month over month. The 12-month rate is now 2.7% — in line with expectations but higher than May’s 2.4% reading.

A grain of salt here: The Bureau of Labor Statistics announced last month it was reducing its sample collection areas across the US. The change is due to staffing shortages at the agency. Fewer workers on hand to check prices means more estimating and guessing in the data.

The department based 35% of its missing prices on other regions of the country or different products in June. Prior to staffing shortages, around 10% was typical.

Sectors most exposed to tariffs, like household furnishings and appliances, were up over the month, increasing 1% and 1.9%, respectively. Prices for new and used cars, on the other hand, declined 0.3%.

Odds of interest rates staying the same later this month increased to 97.4% after the print, per data from CME Group.

Speaking of Fed policy brings us to our second topic: Trump is apparently back at it again with threats against Powell.

The president last night showed a draft letter firing the chair to a group of House Republicans, the WSJ and New York Times reported. Trump on Wednesday, however, told reporters “we’re not planning on doing anything.”

“I don’t rule out anything, but I think it’s highly unlikely,” Trump added. “Unless he has to leave for fraud.”

That last comment comes after the White House alleged Powell either made false statements to Congress about the Fed’s $2.5 billion renovation of its offices, or failed to comply with permit requirements. The challenge came via a letter sent last week from Trump budget director Russell Vought.

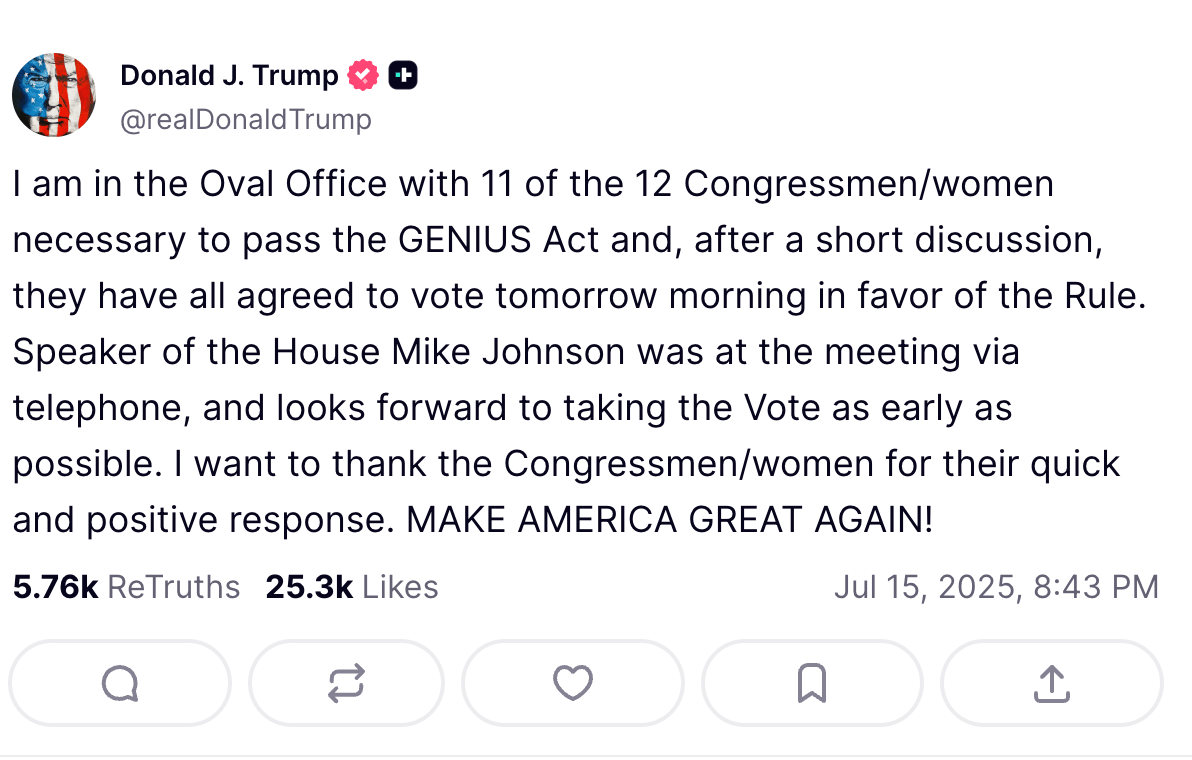

Trump did admit to meeting with House Representatives on Tuesday night, which brings us to topic number three: What’s going on with crypto policy?

In a Truth Social post yesterday evening, Trump wrote:

The post came after the GENIUS Act failed to pass a procedural vote Tuesday. A group of GOP Freedom Caucus members refused to vote in favor of advancing the bill, citing concerns over the GENIUS Act and the Anti-CBDC Surveillance Act being separate pieces of legislation, a person familiar with the matter told me.

Representatives gathered on Wednesday to reconsider the rule, but the deal President Trump stuck with hardliners on Tuesday did not appear to be effective. The drama was still playing out at time of publishing, so keep an eye on Blockworks.co for updates.

The holdup comes as lawmakers and industry members alike insisted the bill was poised to pass. I’ve been told the White House has already scheduled time in the Oval Office for Trump to sign the bill into law on Friday.

— Casey Wagner

Check out the Digital Asset Summit early speaker lineup. Join attendees from BlackRock, Citi, Credit Suisse, Bank of England, Jane Street and more.

Secure your early bird ticket today with promo code: FGNL

📅 October 13-15 | London

This is the amount by which the producer price index increased in June — compared with projections of a 0.2% increase.

It’s a sign that tariffs are apparently not impacting wholesale prices. At least not yet.

M&A hasn’t slowed as Congress mulls crypto legislation and efforts to get more real-world assets onchain continue.

I chatted with Ondo Finance CEO Nathan Allman last month about the RWA space ahead of the company’s tokenization platform launch slated for this summer (Ondo doesn’t yet have a go-live date).

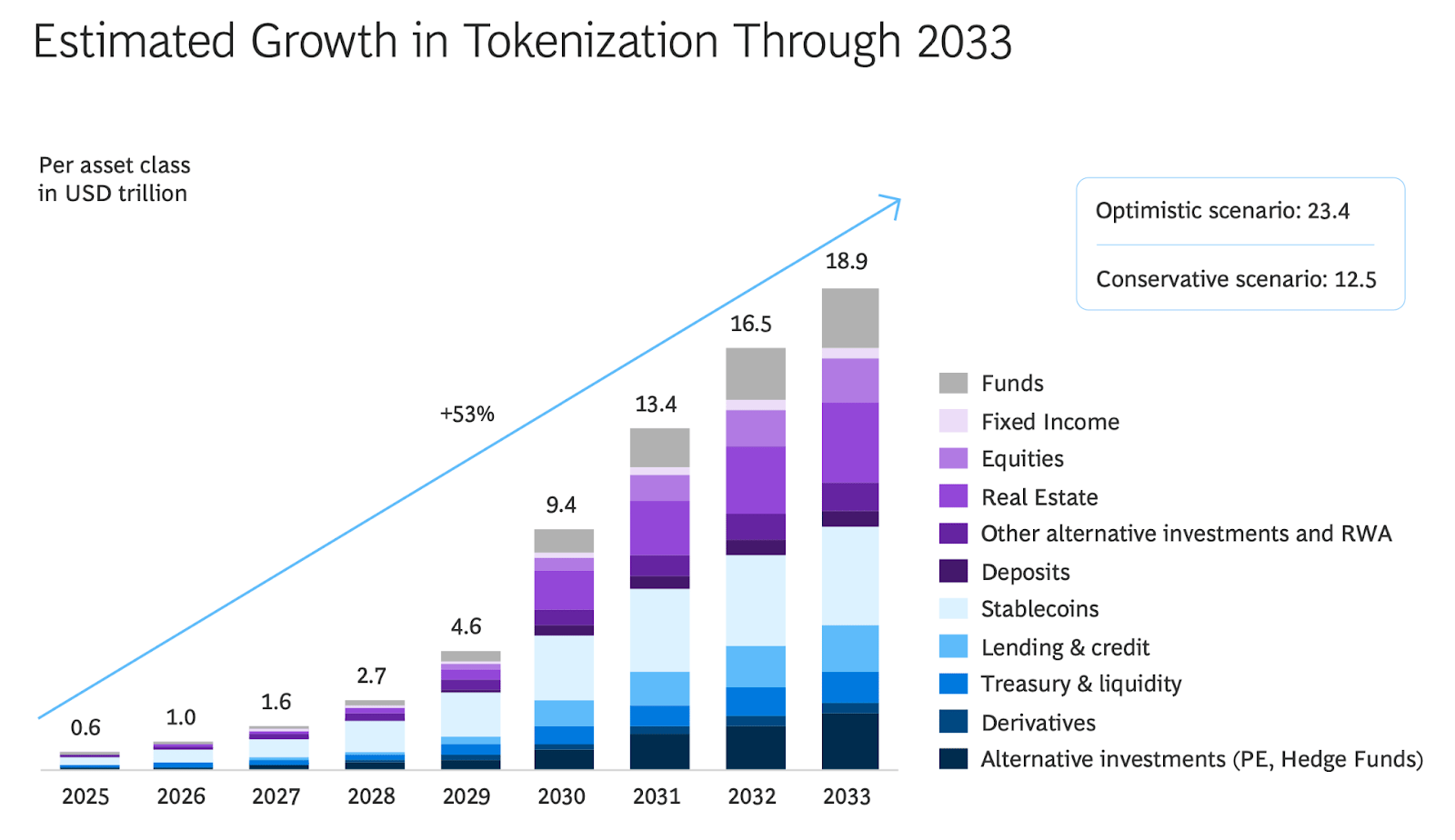

Saying the vast majority of regulated financial assets will ultimately settle on blockchain rails is “not a crazy prediction” anymore, Allman told me. Others agree, including Larry Fink (the man leading the world’s largest asset manager) and Franklin Templeton’s Sandy Kaul (check out my Q&A with her here).

Fast forward to Monday and Ondo said it acquired Strangelove, which focuses on designing and deploying open-source infrastructure across multiple blockchains. This deal was done “strategically” ahead of the aforementioned tokenization platform launch, said Ondo chief strategy officer Ian De Bode.

Called Ondo Global Markets, it’ll initially offer access to 100+ stocks and ETFs — starting on Ethereum and expanding to BNB Chain and Solana.

Strangelove CEO Jack Zampolin said his company’s work on cross-chain communication protocols, permissioned/unpermissioned validator frameworks and modular consensus architecture (that’s a lot of big words) will help Ondo’s platform evolve from a centralized one to a distributed network where institutions can participate in tokenized asset ops.

All told: What stablecoins did for dollars, Ondo is looking to do for securities, De Bode added. At least for the most liquid ones, to start.

Others, like Apollo Global Management, are focusing on tokenization within less liquid segments like private credit.

It’s worth noting that Ondo earlier this month said it would buy Oasis Pro, gaining access to its SEC-registered broker-dealer, alternative trading system and transfer agent. We know how coveted US digital asset licenses are.

Speaking of which, Nasdaq-listed BSGM this week detailed plans to acquire a FINRA- and SEC-registered broker-dealer to one day offer gold-backed tokenized assets for US investors.

It’s not hard to see why companies want in on this space given some of the projections thrown around (like from that April Ripple/BCG report above).

There’ll be plenty of competition here from both crypto-native and TradFi giants, so grab your proverbial popcorn. Better yet, throw an actual bag in the microwave.

— Ben Strack