- Forward Guidance

- Posts

- ✂️ Cut to the chase

✂️ Cut to the chase

Impact of the latest Fed decision prediction

Yes, it’s Thursday. “So why isn’t Felix here?” you ask. He’s enjoying some time off and will return next week. I like reading his macro takes too.

I’ll take this rare Thursday writing opportunity to touch on the upcoming Fed rate decision and its possible effect on crypto markets. Somehow, too, we segue to solana further down.

Impact of expected rate cut to go beyond BTC?

No one is really arguing whether the Federal Reserve will cut rates next week. The conversation has become: By how much? And how will that impact crypto markets?

It’s perfect timing for such a question as more data dropped today.

The Consumer Price Index (CPI) increased 0.4% in August (on a seasonally adjusted basis) — up from a 0.2% rise in July. It rose 2.9% for the 12 months ending August, slightly up from the 2.7% annualized figure last month. Core CPI (excludes food and energy) rose 0.3% in August, as it did in July.

21Shares crypto investment specialist David Hernandez said this data reinforces that inflation continues to moderate to a level that supports next week’s rate cut expectations.

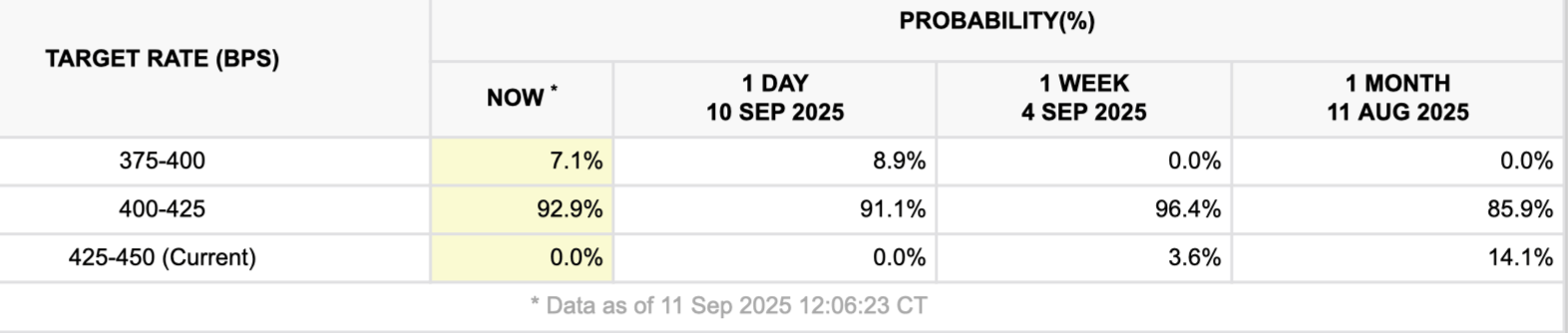

CME Group’s FedWatch tool (using price data of CME Group's 30-day fed funds futures contracts), shows a shift in recent weeks. A month ago, the data implied a ~14% chance the Fed would hold rates steady on Sept. 17. That is now at 0%.

The market, as of Thursday afternoon, thinks a 25bps cut is much more likely than a 50bps cut:

“This comes on the heels of yesterday’s PPI report, which pointed to a sharp softening of producer prices, suggesting that pipeline inflation pressures are easing,” Hernandez explained. “Together, the CPI and PPI data support the view that the Fed can afford to cut rates at their FOMC next week, increasing investor confidence across risk assets.”

Along with the CPI and PPI prints, we saw initial claims for state unemployment benefits rise to 263,000 last week. This was above some expectations and the highest total in about four years.

Aug. CPI rose 0.4%, more than expected. Annualized, that's 5% inflation. However, weekly unemployment claims spiked to 263K, the most since Oct. 2021. The Fed will look past rising inflation and cut rates anyway, due to rising unemployment, a mistake that will worsen stagflation.

— Peter Schiff (@PeterSchiff)

12:46 PM • Sep 11, 2025

Bitcoin rose above $114,000 yesterday before retreating a bit. It then reached as high as $114,700 this morning. It wasn’t far off that level at 1:45 pm ET:

Bitcoin’s next key technical level is just above $115,000, Hernandez explained — “where significant liquidation clusters could fuel increased volatility.” A Fed rate cut and dovish guidance could lead BTC even higher, he said.

“The rate cut opens the door for risk-seeking investors to look beyond bitcoin too — to tokens like solana and XRP, whose ETFs are highly anticipated to debut this fall,” the 21Shares pro argued.

The SEC is set to rule on various US solana ETF proposals by Oct. 10. Not to mention we saw corporate buying of SOL spike last week, per Blockworks Research data.

These SOL buys are much smaller than those by companies acquiring BTC and ETH, but they’re becoming more frequent nonetheless. The below chart shows the same time span but with more assets — giving us a sense of the different scales of acquisition.

Bitwise’s Matt Hougan noted in his latest CIO memo, called Solana Season: “Its promoters argue that Solana is the only blockchain fast enough to support the tokenization of major assets at a global scale.”

There’s that word tokenization again. I’m doing my best to give it a rest.

The convergence of AI, crypto, and capital is turning IP into the next real-world asset class, and the race to unlock it has already begun.

Join Story and Blockworks at Origin Summit, where this new market takes shape.

Use promo code: BWNL50 for 50% off your ticket.

Spread the word and score the reward 🎁

Your network needs to see this — use the Forward Guidance referral program to share expert insights while earning the benefits:

🗣️ 15 referrals: A free ticket to Blockworks’ Digital Asset Summit