- Forward Guidance

- Posts

- 🎂 Better with age

🎂 Better with age

1 year in, demand for ETH ETFs rising

We’ve hit Wednesday. Ben is at the courthouse again monitoring the Roman Storm trial (stay tuned for an update on Blockworks.co). In the meantime, he notes the surge of inflows into US ether ETFs, which today turned one year old.

Casey digs into the US-Japan deal as trade policy deadlines loom. Let’s do it.

ETH ETFs…one year in

Ether ETFs launched in the US one year ago today. Time flies.

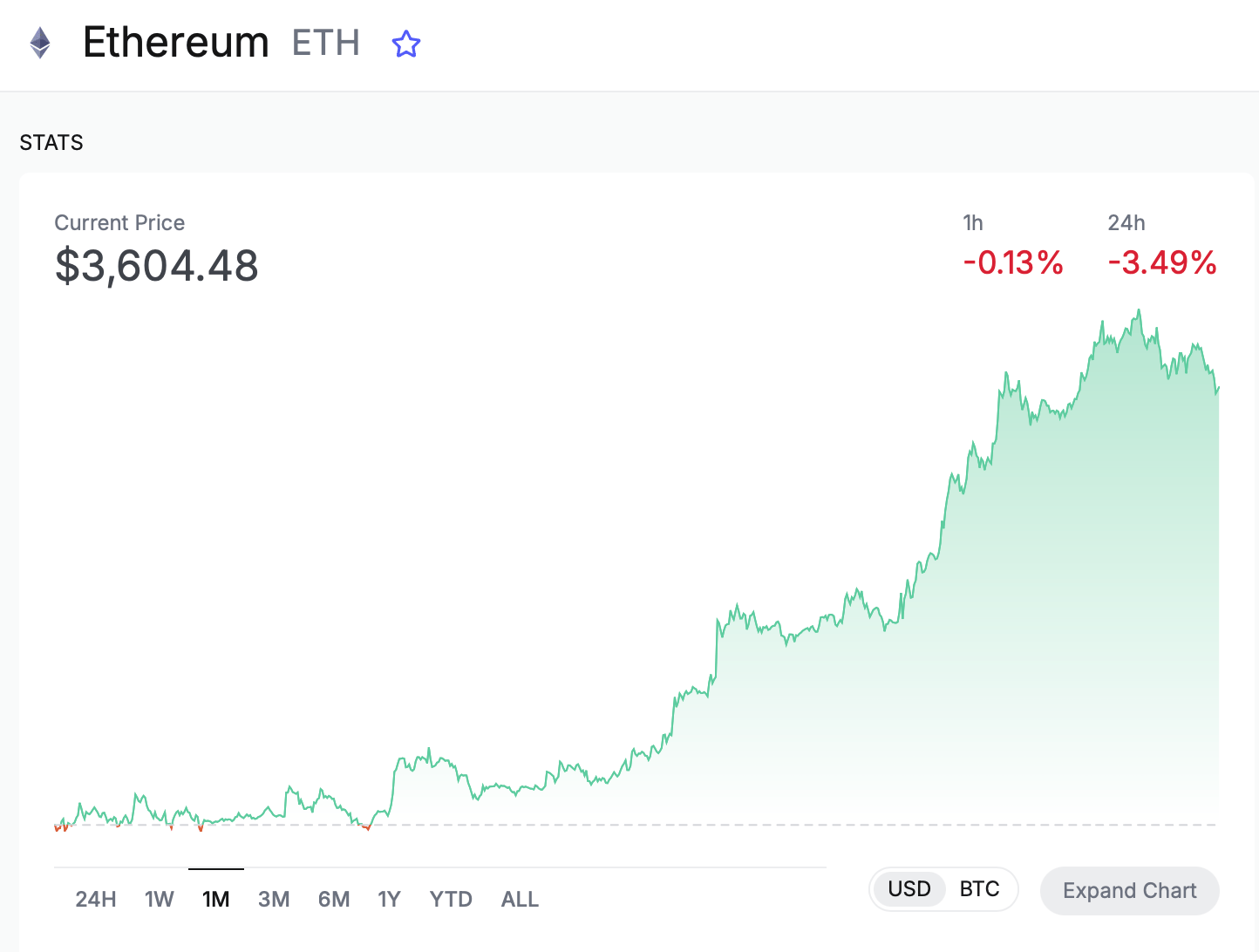

While these products (unlike bitcoin ETFs) struggled to find consistent inflows out of the gate, this month has been a different story.

The ETH funds have attracted $3.6 billion of net capital from July 1 to July 22, Farside Investors data shows.

The segment’s $2.1 billion of inflows last week was nearly double its previous record of $1.2 billion. As CoinShares’ James Butterfill pointed out in a Monday report, the past 13 weeks of inflows represent 23% of the ETH products’ AUM.

2/ The daily flow data reveals sustained demand. The peak was reached on July 16 with a record $726.6 million single-day inflow.

This momentum was maintained with multiple days exceeding $400M, showcasing consistent institutional accumulation throughout the month.

— Blockworks Research (@blockworksres)

5:00 PM • Jul 21, 2025

Institutional demand — rather than just speculative trading — has helped fuel the latest inflows. Corporate treasuries have added more than 600,000 ETH to their balance sheets this month alone, according to Blockworks Research.

Perhaps you remember that Nasdaq-listed SharpLink Gaming in May revealed its ether treasury strategy (and named Ethereum co-founder Joseph Lubin its board chair). The company’s ether holdings were 360,807 ETH as of July 20 — up 29% from a week prior.

BitMine last week said it held roughly $1 billion of ether and has a goal of acquiring and staking 5% of the overall ETH supply.

Globe 3 Capital CIO Matt Lason previously told me that ETH’s combination of scarcity, deflation and yield makes it an ideal asset for a treasury strategy. SharpLink’s ETH staking rewards rose to 567 ETH since it launched the strategy on June 2.

Bitwise CIO Matt Hougan highlighted in a Tuesday memo that ETPs and public companies have combined to buy 2.83 million ETH (worth ~$10 billion today) since mid-May. That’s 32x the increase in ETH’s supply over that span, he said.

So it’s not surprising that ETH’s price has jumped about 60% over the last month.

Because we mentioned staking before, we should note that various asset managers have filed with the SEC to allow their ether ETFs to stake a portion of the underlying holdings. BlackRock joined that movement last week; the world’s largest asset manager typically gets what it wants from the SEC — perhaps because of clout, or knowing when the regulator is ready to approve its proposals). Maybe both.

SEC Commissioner Hester Peirce asked for patience in the SEC greenlighting modifications such as staking and in-kind creations and redemptions. Still, a number of segment observers expect those approvals are imminent.

Investors remain underweight ether ETFs, Hougan wrote in his memo. While ETH has a market cap that’s roughly 20% of bitcoin’s, ETH ETPs have just 12% of the assets that BTC products do.

“With all the excitement surrounding stablecoins and tokenization — which are primarily built on Ethereum — we think that will change, and that we’ll see billions in flows in the next few months,” Hougan added.

As for the next crypto ETFs we expect to see, there was movement yesterday. Sort of.

The SEC approved Bitwise’s crypto index fund proposal. But like it did with the Grayscale Digital Large Cap Fund (GDLC), the order was stayed. This perhaps signals the regulator will wait to roll out a comprehensive framework — about including digital assets in the ETF wrapper — before letting these convert to ETFs and list.

Oh, and also: 21Shares filed for an Ondo ETF yesterday. The Ondo name should ring a bell, as we’ve talked about them getting set to launch a tokenization platform (here’s my Q&A with Ondo CEO Nathan Allman from last month).

— Ben Strack

Check out the Digital Asset Summit early speaker lineup. Join attendees from BlackRock, Citi, Credit Suisse, Bank of England, Jane Street and more.

Secure your early bird ticket today with promo code: FGNL

📅 October 13-15 | London

This is the adjusted annual rate of existing home sales for June, according to data released Wednesday by the National Association of Realtors. It’s a 2.7% decline from May and a nine-month low. Higher home prices (the median cost is now 2% higher than it was one year ago) and increased mortgage rates are likely contributing to the slowdown, the report added.

Pass it on to pocket the perks 🥳

Get others to stay informed at the intersection of crypto and macro, policy and finance. Use the Forward Guidance referral program to spread the word and snag some rewards:

👋 5 referrals: Get a personal shoutout in the Forward Guidance newsletter

With days to go before the new trade policy deadline takes effect, the US struck a deal with Japan.

President Trump announced the deal — a 15% tariff rate on Japanese exports to the US — late last night via a Truth Social post. The rate is lower than the previously proposed 25% levy and also applies to cars and auto parts.

A photo shared on X by Dan Scavino, Trump’s deputy chief of staff, suggests officials were making changes to the policy up until the last minute. The document in the picture had been edited by hand, with $400 billion crossed out and replaced with “500.”

The new figure appears in line with the message both sides are touting: that the agreement includes $550 billion in investments and loans from Japan to the US. Trump added in his Tuesday post that the deal will result in hundreds of thousands of jobs.

Domestic auto manufacturers may not be as happy with the deal, though.

With Japan auto exports now taxed at 15%, it’s more expensive for US makers like Ford and GM to import vehicles and parts from countries such as Mexico (25% levy) than it is for Japanese auto makers to send vehicles to the US. Check out yesterday’s edition for a recap on how tariffs are already hitting car makers’ bottom lines.

The White House has not yet commented specifically on how the new Japanese deal will impact cars, nor has it shared any information about the status of other negotiations. We’ll be listening, though.

— Casey Wagner